Business Banking Upgrade

Business Banking Upgrade

Exciting news: your Bank of the Valley online business banking experience has gotten an upgrade!

Now, you have access to a fresh, modern design and easier ways to manage your money - from everyday spending to your business's biggest moments.

WITH THE UPGRADE YOU CAN EXPECT:

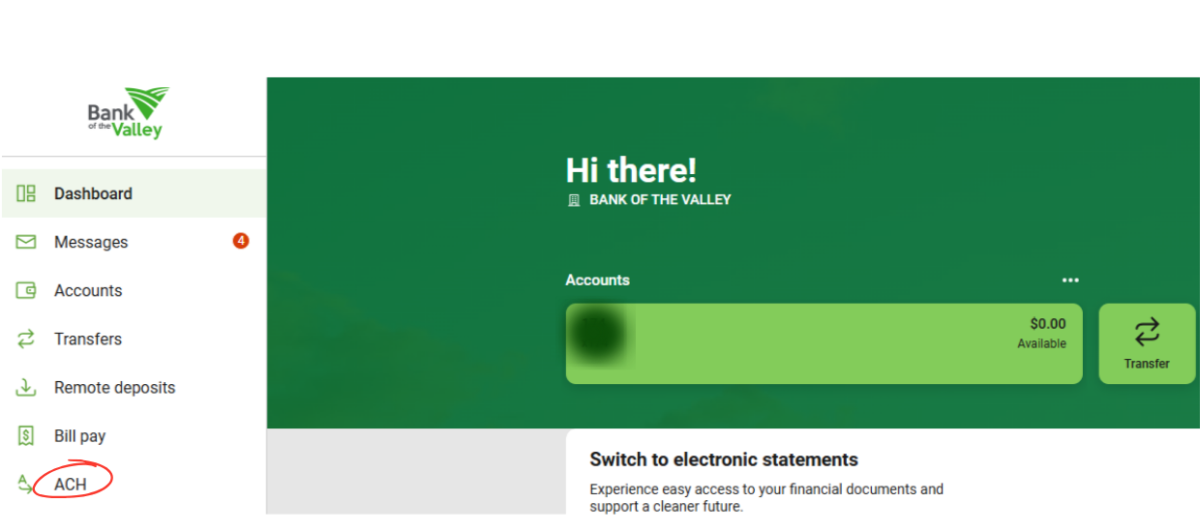

- Seamless, user-friendly, modern dashboard

- Enhanced alert and reporting functions

With this upgrade, you'll notice a new option within the landing page of your online business banking portal for processing ACH files:

**YOUR LOGIN CREDENTIALS WILL REMAIN THE SAME**

Click on the "VIDEO TUTORIAL" below for a step-by-step tutorial on sending ACH files:

VIDEO TUTORIAL

Bank of the Valley is a Member FDIC, Equal Housing Lender.